Although it's obvious that having enough money is a prerequisite for retiring early (although there is a question as to what is enough), once I became comfortable that the money side of my early retirement worked, I quickly realised that the things I do are much more important than the money. Because of this, I'll start off this month looking at my early retirement targets and, only after that, will I look at my early retirement costs.

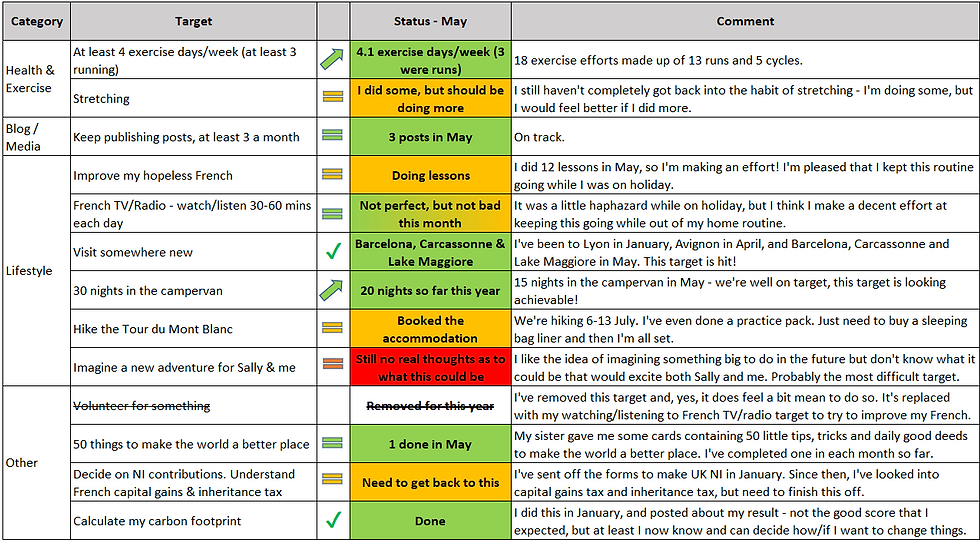

Early retirement targets

Of course, the items on my targets list are only part of what I do, but they are the things that I particularly want to accomplish this year. After just five months, there is plenty of green and amber, showing that I'm heading in the right direction. This month, I'm particularly pleased that I kept on track despite spending two thirds of the month on holiday and therefore out of my normal routines, even if that did require me to do 14 runs/cycles during the last 12 days of the month!

Writing this post is a good opportunity to check on my progress and see if there are any areas that I want to focus on during the coming month. Stretching is one area where I want to do better, and another is my target to understand French capital gains and inheritance tax so that I don't make any bad tax decisions. I'll see if I can add some green to at least one of those targets in the next month - stretching sounds much more likely than tax!

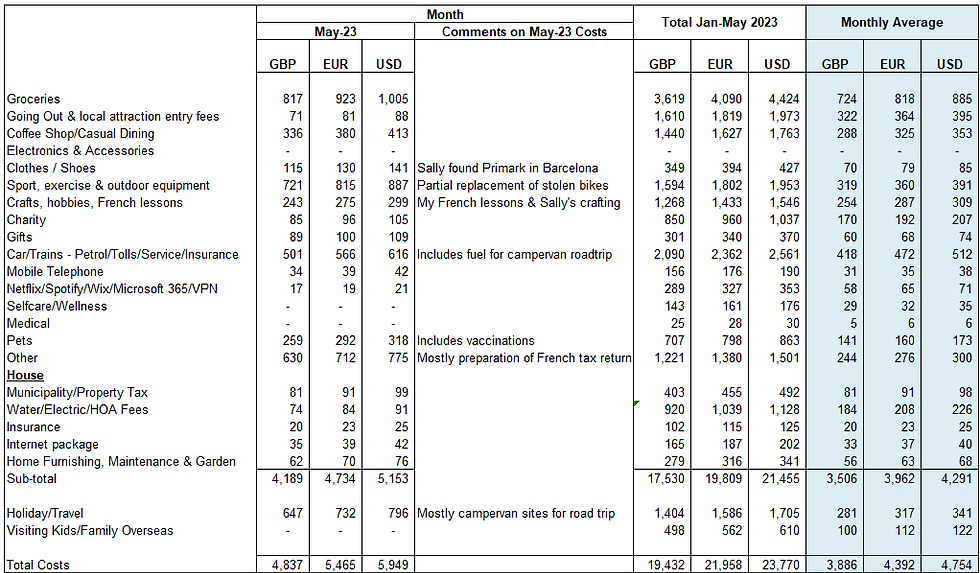

Early retirement costs

We had three sets of extra costs this month:

Buying new bikes after our bikes were stolen (there's a bigger cost still to come under this heading as we still need to replace Sally's ebike)

Paying for our French tax returns to be prepared. I could (probably should) do this myself, but different country tax rules and a language that I'm not great at has made me take a cautious approach - I don't want to make a mistake, and just paid €618 / £547 / $673 to make sure that I don't.

We spent money on our campervan trip - not too much, but it's not a cost we have every month.

The good thing about these extra costs is that we can afford them, which got me thinking about one more year syndrome again, the act of continuing to work another year (or more) beyond the chosen retirement date.

There are pros and cons, and no right answer to whether one more year is a good or bad thing to do. I enjoy my life and wouldn't want to swap a year of my early retirement for more money earned from an extra year at work.

But I also like that our financial situation means that our bikes being stolen isn't a disaster and doesn't spoil my whole day, because I know we can afford to replace them. Last month, Sally and I listed ten things that we're grateful for, I can add this to make it eleven things for which we're grateful.

Wow groceries is high this month - is this for two people - and didn't know they had Waitrose in France (only joking) 😵